Mazars webinar: Transfer Pricing - How can MNEs mitigate the impact of Covid-19 on their Transfer Pricing reviews? (21 Sep 2021)

Four priority issues were identified and covered in the Guidance:

- Comparability analysis

- Losses and the allocation of Covid-19 specific costs

- Government assistance programmes

- Advance Pricing Agreements (“APAs”)

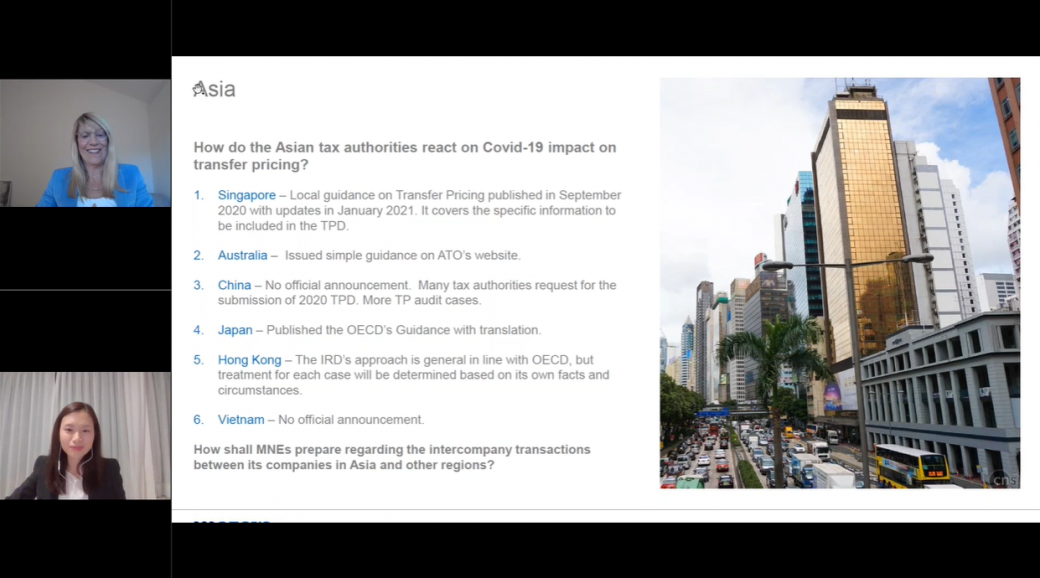

Mazars global transfer pricing experts organized the webinar on 21st September, at 8:00pm (HKT), to assist MNEs in mitigating the impact of Covid-19 on transfer pricing. Our Senior Manager of Tax Advisory Services at Mazars in Hong Kong, Karen Lau was one of the speakers and shared her views on different Asian tax authorities’ reactions on Covid-19 impact on transfer pricing.

The webinar covered topics including OECD Guidelines, key take-aways for 2020 and suggestions for MNEs. As a conclusion, the COVID 19 will impact transfer pricing during and post crisis. The crisis period may be longer for certain sectors such as aircraft industry, tourism etc. MNEs need to closely manage their Transfer Prices and prepare robust TP documentations to face the future Tax Audits.

Know more