January 2015 - Easing of tax treatment in corporate restructuring activities in China

China: corporate restructuring tax treatment

To achieve the objective, Circular 14 sets forth directives from different areas such as expedition of the approval procedures, improving financial services, etc. Above all else, the State Council has also targeted to optimize finance and tax policies related to corporate restructuring activities. Circular 14 specifically states that policy for the Special Tax Treatment (to be explained in the next section), will be revised to minimize tax costs on corporate restructuring activities and optimize Corporate Income Tax (“CIT”) treatment of non-monetary assets investment transactions.

Later in December 2014, the Ministry of Finance (“MOF”) and State Administration of Taxation (“SAT”) jointly issued two circulars, Caishui [2014] No. 109 and Caishui [2014] No. 116 (“Circulars 109 and 116”), effective retrospectively on 1 January 2014, to implement the above two tax treatments.

Circular 109 - Easing of tax treatment for M&A activities

In 2009, the MOF and SAT jointly issued a circular Caishui [2009] No. 59 (“Circular 59”) which set out two distinct Corporate Income Tax (“CIT “) treatments applicable to M&A transactions – the General Tax Treatment (“GTT”) and Special Tax Treatment (“STT”).

Under GTT, the assets or equity transfer gain or loss should be recognized upon occurrence of corporate restructuring transaction, and the tax basis of the related assets should be based on the fair value regardless of the transfer nature, i.e. whether it is within the group for internal restructuring purpose or not. The gain derived will be subject to CIT and become an additional cost for M&A transactions. Under such circumstances, group restructuring activities may have been hindered and capital market activities may have borne unnecessary additional costs.

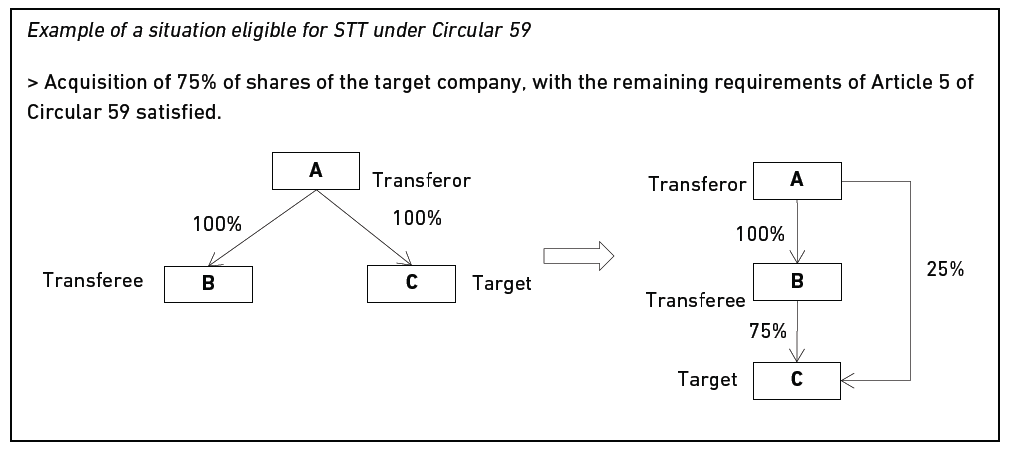

However, the transferor and transferee become eligible to the STT on the transaction whereby no gain will be recognized and chargeable to CIT, if they fulfill the following criteria:

- The restructuring has reasonable commercial objective and its main objective is not to reduce, waive or defer taxes

- The ratio of the purchased equity to the total equity of the acquired enterprise (or the acquired assets to the total assets of the transferor in the case of asset deal) has to be at least 75%.

- The original business activities of the assets involved remain unchanged over the 12 consecutive months after restructuring.

- A minimum of 85% of the total consideration is settled by equity.

- The original major shareholder does not transfer the equity received within the next 12 consecutive months after restructuring.

The above can be illustrated in the following diagram.

Once STT is granted, no gain or loss is recognized temporarily (subject to adjustment if part of the consideration is not settled by equity). The original tax basis of the transferred equity / assets can still be adopted by both the transferor and transferee as the tax basis. Please note that there are additional requirements for applying STT for cross border restructuring transactions, and related discussion is not the focus of this newsletter.

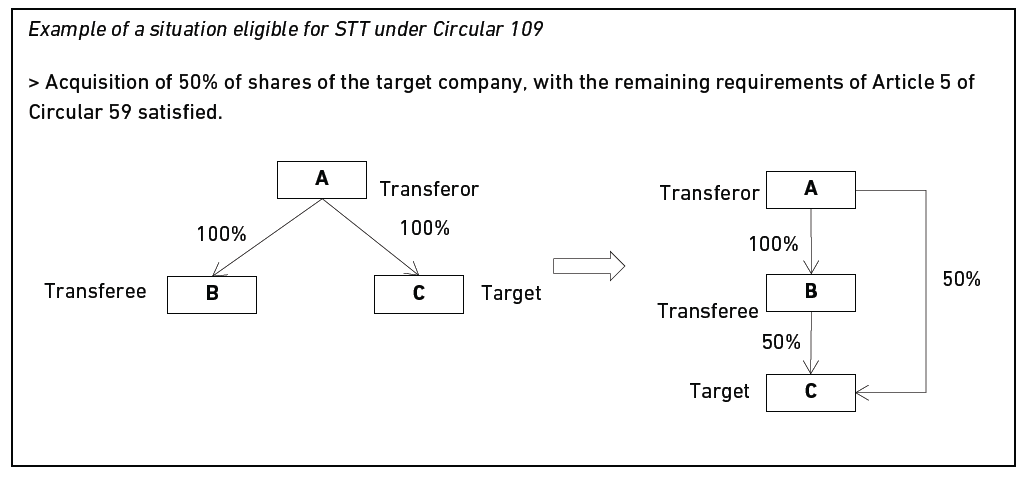

Circular 109, first of all, has reduced the ratio in the second criteria above for STT from 75% to 50%:

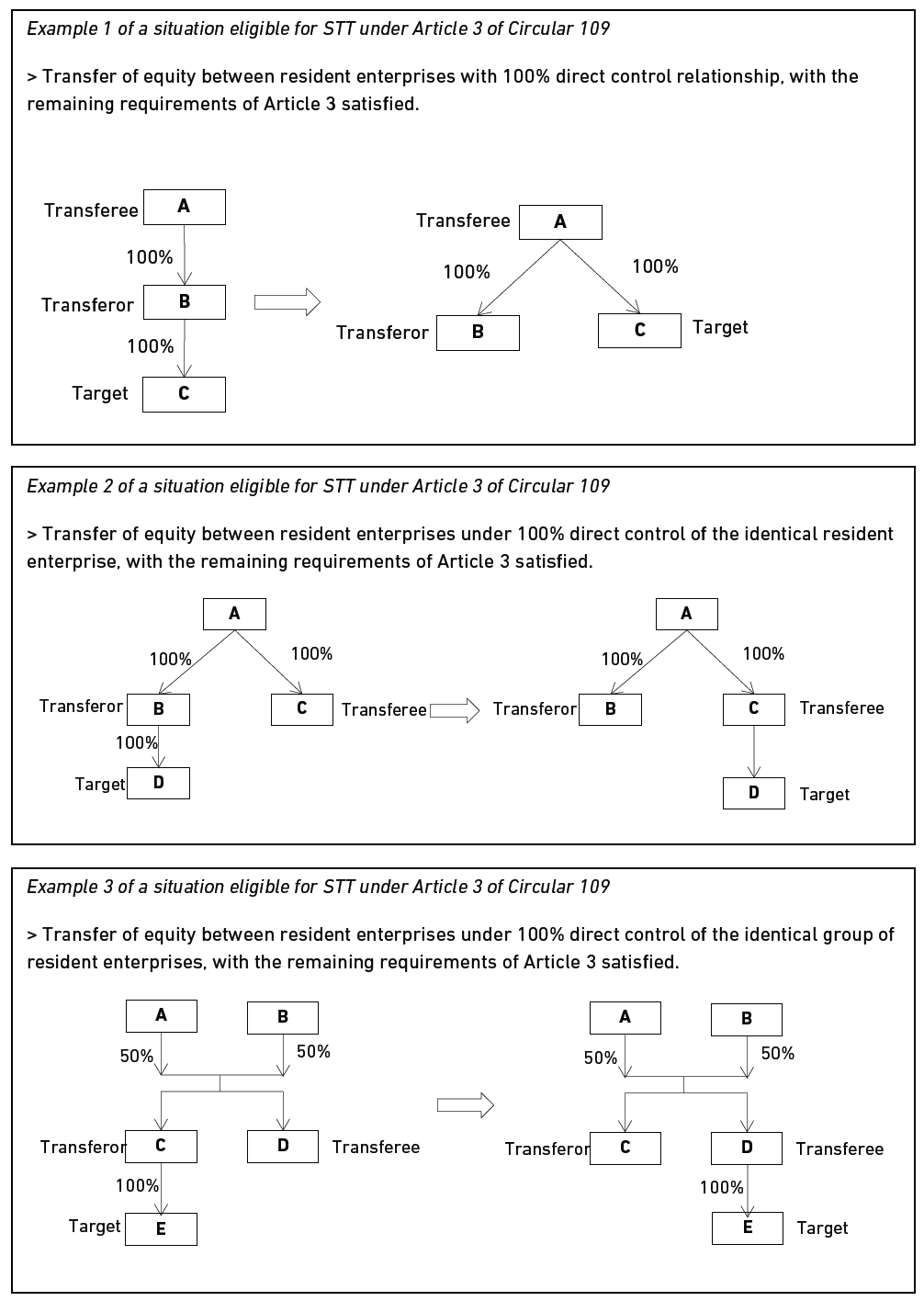

Circular 109 has also provided a separate special treatment to cater for domestic internal restructuring. The requirements are:

- The equity or assets are transferred, at net book value, between resident enterprises with 100% direct control relationship, or between resident enterprises which are under 100% direct control of the identical resident enterprise or identical group of resident enterprises.

- The transfer has reasonable commercial objective and its main objective is not for reduction, waiver, of deferral of taxes

- The original business activities of the transferred equity or assets remain unchanged within the 12 consecutive months after restructuring.

- No accounting gain or loss has been recognized by the transferor and transferee.

The new special tax treatment can be illustrated in the following diagrams:

The requirements categorically specify ‘resident enterprises’ as the applicants. In other words, cross border restructurings involving non-PRC resident enterprises cannot enjoy this new special tax treatment. The special treatments are:

- The transferor and transferee enterprises do not need to recognize gain.

- The transferee enterprise’s tax basis for the equity or assets transferred is determined by the original net book value of the transferred equity or assets.

- The transferee enterprise’s depreciation of the assets transferred is calculated based on the original net book value.

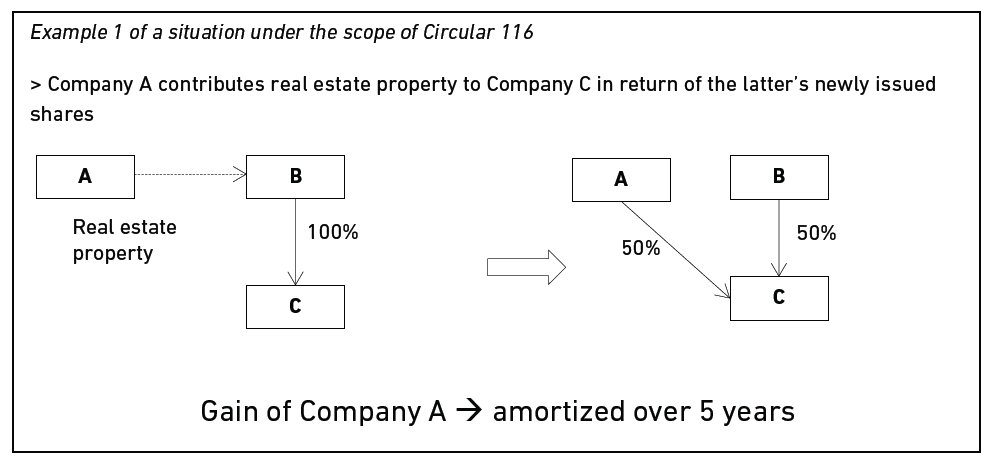

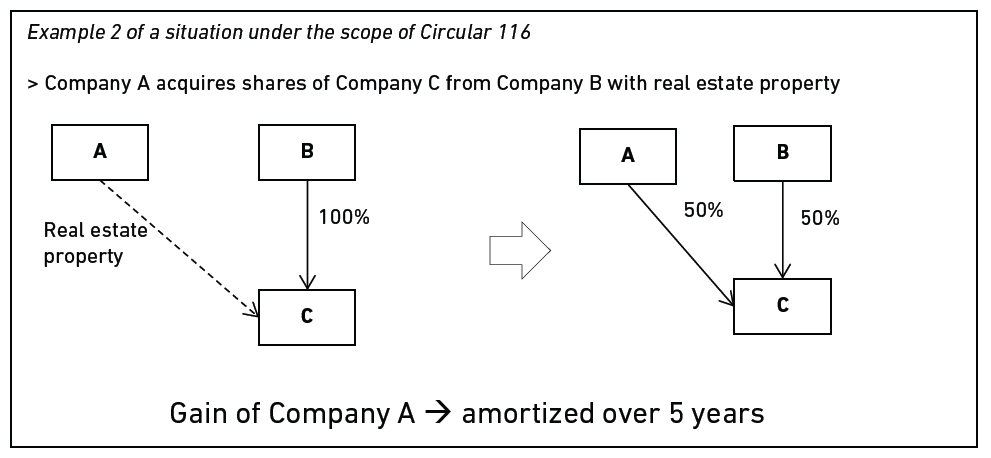

Circular 116 - Optimization of CIT treatment on investment with non-monetary assets

The issuance of Circular 116 follows the directive of Circular 14 to optimize CIT treatment on investment with non-monetary assets. The circular extends the ambit of CIT alleviation measures aiming at reducing the investors’ tax burden and activating of the market.

Under Circular 116, a resident enterprise’s gain derived from investment in another enterprise, with non-monetary assets contribution (i.e. assets other than cash, bank deposits, receivables, notes, bonds, etc.), can be deferred and amortized for a maximum term of 5 years for CIT reporting purpose. The gain is defined as the balance of the fair value of the non-monetary assets (after valuation) from which is deduced the tax basis. This will defer the immediate tax burden over a period of 5 years for enterprises entering into such investment transactions.

If one the following incidents occurs, the deferral will however stop and all the remaining balance of gain will be reported in the Annual CIT filing for the corresponding year:

- The equity acquired with non-monetary asset is transferred within 5 years after investment.

- The investment is withdrawn.

- The investor enterprise is de-registered.

Remarks

The PRC government has viewed M&A and corporate restructuring as possible measures to improve the industry structure and enhance the development of capital market. However, the PRC government also recognizes various obstacles to the M&A market development, one of which is the enterprises’ additional costs resulting from different taxes. Circulars 109 and 116 have therefore marked the first step of MOF and SAT in optimizing China’s tax policies aiming at encouraging the M&A market.

Besides CIT, Circular 14 also mentioned that other tax regimes, for example, Land Value Added Tax (“LVAT”), in relation to M&A and restructuring activities should be optimized. As Circulars 109 and 116 have not addressed these areas, the MOF and SAT will probably issue more policies and clarifications focusing on other special tax treatment (e.g. regarding LVAT) aiming at further boosting the M&A markets and activities. Since the tax liabilities involved can be substantial, companies planning to restructure in the near future should keep themselves updated on the development of this topic and consult with tax professionals in a timely manner.