Mazars has released a global study – The race to data maturity: is your business as far ahead as you think? – which takes a closer look at the concept of data maturity.

The study examines over 1,100 survey responses from senior business leaders in 21 countries, including 203 in Asia-Pacific (APAC). While more than 80% of respondents believe they’re more data mature than their competitors, less than half (43%) meet best practices when it comes to data quality.

In APAC, digital transformation investments have accelerated in recent years, and data plays a central role in the rapidly growing digital economy. Below, Kee Yin Lai, Associate Director, Risk Consulting reacts to the findings and shares his insight.

What is the state of data maturity in APAC?

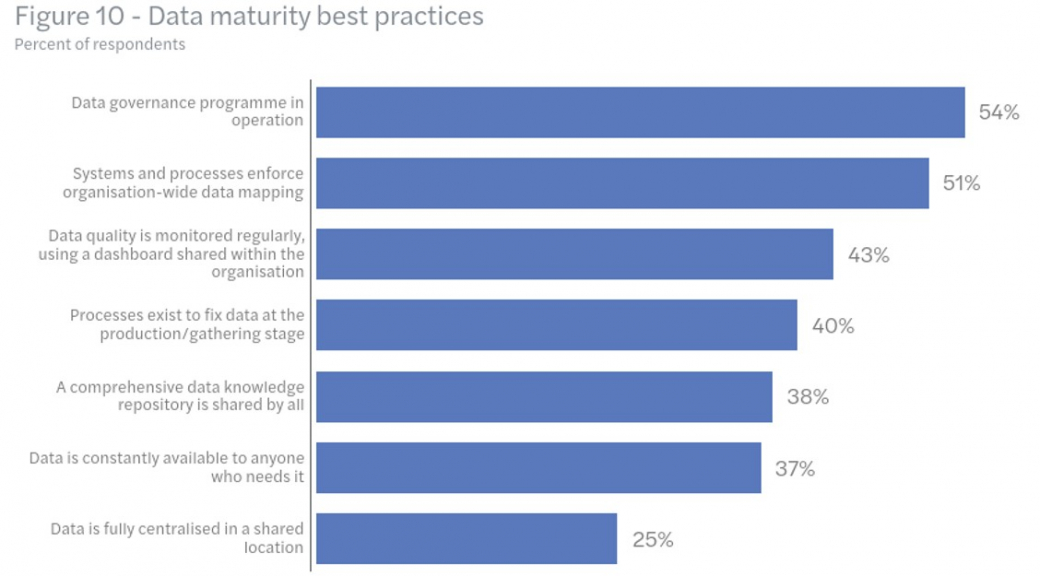

A high level of maturity implies effective data governance that help organisations produce better business outcomes. From our survey, only 38% of businesses at the global level have a comprehensive data knowledge repository that is shared by all.

Approaches to data governance vary significantly across APAC and not all countries in the region have comprehensive data regulations in place. For instance, APAC displays the lowest level of maturity and lags behind their North American, African/ Middle East, Latin American and European counterparts in terms of data centralisation.

Our study reveals that only 21% of businesses in the region have fully centralised data or meet best practices on making data consistently available to users, providing clearer oversight of compliance and insights into how their data is being used.

This comes as 36% of businesses in North America and 24% in Europe indicated that their data is completely centralised.

Businesses operating in APAC have ground to make up on data knowledge repositories and data governance. They need to recognise and identify their data maturity gaps in order to enhance data capabilities and drive the agenda forward.

Data relay: how do we strengthen cooperation between all business areas to drive value?

Data-driven decision-making requires collaboration at every level of the organisation. However, when the employees imputing the data aren’t the ones leveraging it to create value, there may be substantial impact on the quality of data collected. Quality issues are one of the most significant obstacles to extracting value from data.

The key to addressing this issue is reskilling the workforce, enabling them as business partners. It is known that digital skills gap remains a major challenge across APAC, and the disconnect has widened during the pandemic.

Our global study finds that over the next 12 months, 32% of businesses are prioritising organisation-wide capability building to enable all parts of the business to use data. Meanwhile, 25% are focusing on hiring, training and developing internal data specialists.

With more investment in data quality training for all key data roles, companies would be better equipped to respond to new challenges and strengthen the organisation’s data culture. Data quality will improve as data management matures.

What are the top data governance trends and tools for businesses in the region?

Most businesses understand being data-driven is no longer optional; it’s required. The overwhelming majority of respondents to our survey have invested in collaborative tools to facilitate data maturity, and will continue their investments into 2022.

Across APAC, businesses increasingly see the potential of big data analytics and emerging technologies. We can see organisations rapidly making innovative pivots to meet disruptive change. Here are some key data trends that will reshape the future.

Artificial Intelligence (AI) has the ability to efficiently transform real-time data management and enable companies to extract the maximum value from their data.

It comes as no surprise that AI is cited as the field receiving most investments in 2022 in our study. Some 43% of data leaders report their organisation intends to make “major” new investments in AI in the coming 12 months, and 70% of organisations forecast some new investment.

- Shared dashboard to monitor data quality

Monitoring data quality is key to business growth. The report finds over half of businesses predicting high revenue growth in 2021 regularly monitor their data using a dashboard shared within the organisation.

A shared dashboard enables analysts to track and gain real-time insights into the quality of data collected and help them take action to fix any arising issues.

In APAC, cloud computing has grown tremendously and continues to gain strong momentum, fuelled by increasing demand amid the COVID-19 pandemic.

The cloud offers many opportunities to a data-driven business, allowing them to derive better insights. Cloud analytics enables an organisation to scale seamlessly and help the data team to focus on high level tasks that contribute to the bottom line.

However, adopting all these technologies are not without its risks. Establishing a comprehensive cyber security guideline will help businesses in the long run.

Conclusion

While our research reveals the overwhelming confidence that business leaders have in their data maturity level, many organisations are still struggling to meet best practices which critically underpin data maturity.

All signs are pointing to a data revolution across APAC. Data leaders in this region will need to carefully examine the gaps that they have and work to close the confidence gap in order to manage the data complexity in the future and the challenging disruptions ahead.

Read the full report of our global data study, developed in partnership with Data Galaxy, to gain insights on mapping a clear path towards data maturity.

APAC respondent details (203 companies)

Annual revenue (EUR) | Sample |

<EUR 500m | 73 |

EUR 500m – 1.5bn | 57 |

EUR 1.5bn – EUR 5bn | 49 |

EUR 5bn+ | 24 |

Industry | Sample |

Financial Services (inc. Banking, Insurance, Asset Management) | 31 |

Technology & Telecoms | 44 |

Mobility, Transport & Logistics | 7 |

Retail & Consumer Products | 28 |

Healthcare, Life Sciences, Pharmaceutical | 8 |

Energy, Infrastructure & Environment | 13 |

![Futuristic corridor GettyImages-969187372[2].jpg](https://www.mazars.hk/var/mazars/storage/images/_aliases/card/media/local-contents/hong-kong/futuristic-corridor-gettyimages-969187372-2-.jpg/53800875-1-eng-GB/6cd19f3a81ed-Futuristic-corridor-GettyImages-969187372-2-.jpg.jpg.webp)