Hybrid seminar: PRC and HK tax considerations in M&A (19 June 2023)

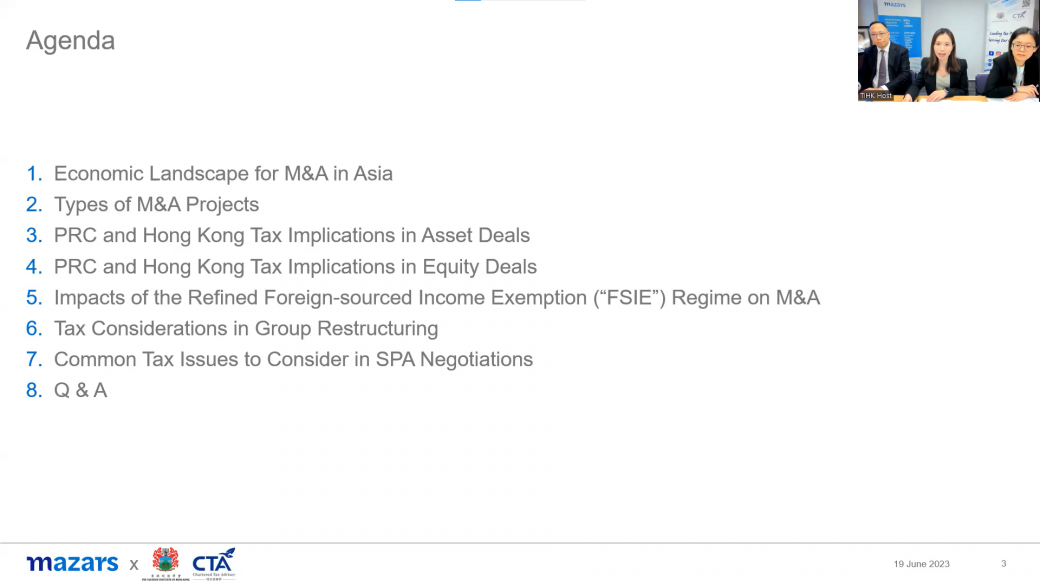

On 19 June 2023, our hybrid seminar, “PRC and HK tax considerations in M&A” was successfully held by The Taxation Institute of Hong Kong (TIHK) together with our Tax Directors Karen Lau and Grace Xia , moderated by Daniel Chow.

During this seminar, we shared insights of M&A in Asia from tax perspective, introduced different types of M&A projects, and compared the PRC and Hong Kong tax implications in Asset Deals and Equity Deals etc.

If you want to know more about the tax insights in M&A, please feel free to contact our Tax experts.